Market Trends and Insights: Understanding Economic Shifts

This Friday, as we wind down the week, it's vital to dissect the latest market shifts and their implications for wealthier Philadelphians. A collection of notable reads reveals significant trends affecting the economy:

- The Market Check: The ever-watchful market has prompted Congress to tread carefully, with various law firms adjusting their positions. Roger Lowenstein's insights provide a historical lens to view these developments.

- Tariff Truths: The discussion surrounding tariffs is rife with misconceptions. A recent piece critiques the Trump administration's justification for tariffs, underscoring how trade imbalances often obscure deeper economic realities.

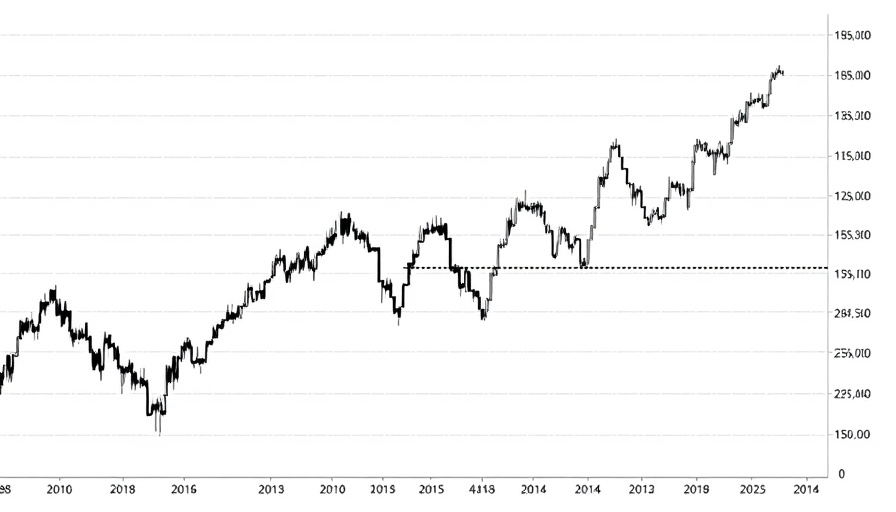

- Recovery Timelines: For investors, the length of market recoveries following significant downturns is crucial information. Data shows recoveries can span anywhere from seven months to two years, highlighting the importance of long-term strategy over short-term panic.

- Luxury Real Estate Trends: Ken Griffin's influence on the luxury housing market raises questions. As billionaire buyers drive prices higher, what does this mean for the average consumer?

- Affordability Issues: In light of rising inflation, the dream of homeownership is evolving. Notably, homes are decreasing in size as economic pressures challenge traditional housing desires.

Additionally, amid this economic landscape, Philadelphians should remain aware of recession signals. Experts like Bill McBride suggest that while the U.S. economy shows resilience, proactive measures such as building liquid savings are essential, especially for those nearing retirement.

Engaging with these reads will not only enhance your understanding of current events but also position you to make informed financial decisions moving forward. For those keen to stay updated, consider subscribing to the weekly mailing list for more curated insights.

Add Row

Add Row  Add

Add

Write A Comment