Reflecting on an Exceptional Market Era

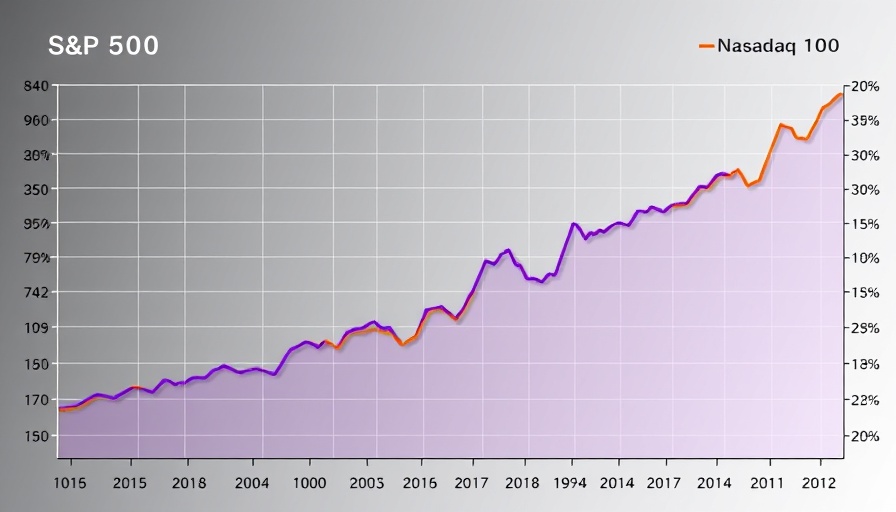

Since the Great Financial Crisis (GFC), the stock market has witnessed remarkable growth, particularly from January 1, 2010, to the end of the first quarter in 2025. The S&P 500 has achieved a total return of 566.8%—an average of 13.3% annually during this period. Comparatively, this outpaces the century-long average return of around 10.4% and positions the current era as one of the best in history.

The Weight of Historical Context

This remarkable performance can be attributed to a host of factors, including favorable economic conditions and advancements in technology that revolutionized industries. For instance, the peak returns during this 15-year span are surpassed only by the post-World War II boom and the tech boom that ended in 1999. Interestingly, amid these exceptional returns, investors encountered only minor setbacks like dips in 2011 and a significant downturn in early 2020 due to the pandemic.

Understanding Market Behaviors

Investors, referred to as “BTFD” players (buy the dip), have developed a tendency to capitalize on market dips, reflecting a 'muscle memory' built over years of rising equity markets. This habit challenges many to rethink their approach as they face the psychological effects of market downturns. Events like the 1987 crash, which many investors survived, have created a frame of reference that may dull the emotional impact of recent movements in the market.

The Importance of Mindset

As we navigate an era of unprecedented gains, it is vital for top wage earners in Philadelphia to recognize both the current opportunities and the inherent risks of investing in volatile markets. The shifts in investor mentality can significantly impact financial decisions, and understanding these patterns can lead to better strategic choices.

Diplomatic Insights for Future Success

What actions are possible when we consider this information? Investors are encouraged to evaluate their portfolios, acknowledge past behaviors, and prepare for a market that may not always provide similar returns. With mindful strategies and a resilient mindset, there lies an opportunity for substantial long-term wealth generation.

Add Row

Add Row  Add

Add

Write A Comment